It is ranked only the seventh-largest in the world, according to the Sovereign Wealth Fund Institute. A state-owned investment fund like the PIF is not unique. It is aiming to top $1 trillion within a few years. The Saudi Public Investment Fund is a government-controlled fund that has $650 billion in assets under management, according to its most recent filing.

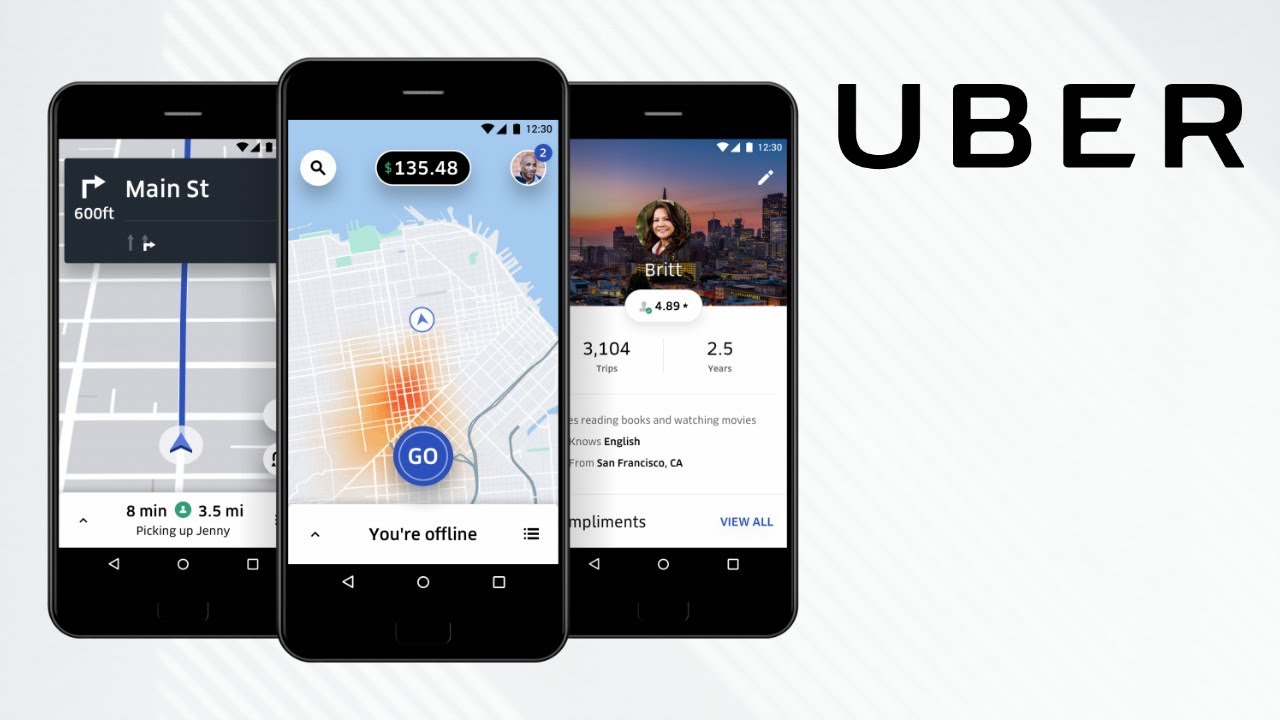

But that is only a small sliver of the money it is sinking into a number of prominent businesses elsewhere around the globe as the kingdom moves to diversify away from a dependence on oil income – and as the petro-kingdom tries to achieve its political goals. Note: If you received non-fare income, but didn’t receive a 1099-MISC, you still have to report that income on your taxes.Saudi Arabia’s mountain of cash has upended the world of professional golf. You likely didn’t receive one if you didn’t earn any income from bonuses, referrals, or promotions. Keep an eye out for your 1099 at the address you gave to Uber. From there, you can opt in to electronic delivery. You can also find your 1099s in your Driver app by going to Rewards → Manage money and taxes → Tax Information. Download your 1099s and Yearly Summary to your computer. At the top of the page, select "Tax Information."Ĥ.

On the left-hand side of your Uber Rewards Dashboard, select “Partner Earnings.”ģ. Here's how you can access it on a computer:Ģ. You can find your tax information online in your partner account or in your Driver app. Uber will make your 1099s available in 2 different ways: 1. This means that if you did work for Uber in 2022, you’ll receive your 1099s on or before January 31, 2023. Nervous that you haven’t received your Uber 1099s yet? Don’t worry - if it’s before January 31, you’re right on track.Ĭompanies that work with contractors - like Uber, Lyft, Postmates, and other on-demand companies - aren’t required to send out their 1099s until January 31 of the year after the work was performed.

0 kommentar(er)

0 kommentar(er)